Cost Drivers Examples In Service Industry

— 'Cost drivers are the structural determinants of the cost of an activity, reflecting any linkages or interrelationships that affect it'. Therefore we could assume that the cost drivers determine the cost behavior within the activities, reflecting the links that these have with other activities and relationships that affect them.

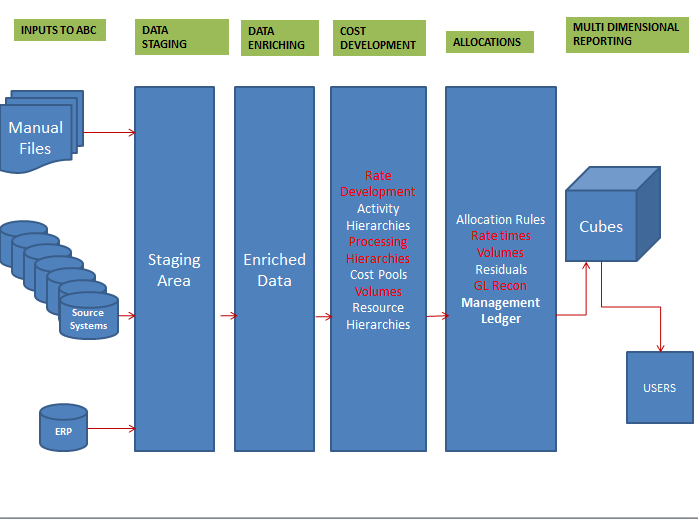

The (ABC) approach relates to the activities that drive them to be incurred. Activity Based Costing is based on the belief that activities cause costs and therefore a link should be established between activities and product.

Find a Travel Service Office. 5 Cost Drivers To Help You Make Accurate Expense Projections. Other examples include rent (square footage allocated per employee. Jun 28, 2018 - Examples of Cost Drivers. The most common cost driver has historically been direct labor hours. More technical cost drivers include machine hours, the number of change orders, the number of customer contacts, the number of product returns, the machine setups required for production, or the number of inspections.

The cost drivers thus are the link between the activities and the cost. Generally, the cost driver for short term indirect may be the volume of output/activity; but for long term indirect variable costs, the cost drivers will not be related to volume of output/activity. In traditional costing the cost driver to allocate indirect cost to cost objects was volume of output.

With the change in business structures, technology and thereby cost structures it was found that the volume of output was not the only cost driver. John Shank and Vijay Govindarajan list cost drivers into two categories: Structural cost drivers that are derived from the business strategic choices about its underlying economic structure such as scale and scope of operations, complexity of products, use of technology, etc., and Executional cost drivers that are derived from the execution of the business activities such as, plant layout, work-force involvement, etc. Resource cost Driver is measure of quantity of resources consumed by an activity. It is used to assign cost of a resource to activity or cost pool. Activity Cost Driver is measure of frequency and intensity of demand placed on activities by cost object. It is used to assign activity costs to cost objects.

To carry out a analysis, ABC is a necessary tool. To carry out ABC, it is necessary that cost drivers are established for different cost pools. Examples [ ] Some examples of indirect costs and their drivers are: indirect costs for maintenance, with the possible driver of this cost being the number of machine hours; or, the indirect cost of handling raw-material cost, which may be driven by the number of orders received; or, inspection costs that are driven by the number of inspections or the hours of inspection or production runs.

In marketing, cost drivers are Number of advertisements, Number of sales personnel etc. Kenko k chasam instrukciya for kids.  In Customer service, cost drivers are Number of service calls attended, number of staff in service department, number of warranties handled, Hours spent on servicing etc. References [ ].

In Customer service, cost drivers are Number of service calls attended, number of staff in service department, number of warranties handled, Hours spent on servicing etc. References [ ].

Job-order costing Job-order costing is often thought of as a costing method for producers of custom goods. However, this method is well-suited for service companies as well. In a job-order costing system, companies assign costs such as direct labor or direct materials directly to jobs as they are incurred. In addition, the company allocates overhead, such as utilities costs, insurance costs and licensing fees, to jobs based upon a predetermined overhead rate. This rate is based upon an estimate of the total amount of overhead costs the company is expected to incur throughout the year.

This method allows for companies to make timely estimates of job costs and ensure that all costs of rendering services are applied to jobs. Activity-based Costing Activity-based costing methods are well-suited to service companies, because they offer flexibility that job-order costing systems do not. Like job-order costing, activity-based costing assigns traceable costs directly to jobs; however, overhead costs are assigned to jobs based upon different activities. For example, in a cleaning company, workers may take customer orders, schedule appointments, clean houses and clean offices.